Share this Post

Tax Deferral & Tax Arbitrage is a Powerful Combination

You already know how tax deferral works. That’s why you max out your 401(k).

But what if you could use the same strategy on a much bigger part of your income?

For many top earners, there’s a little-known benefit quietly sitting in their compensation plan. And it only exists if your employer offers it. I’ve seen some of the most meticulous DIY investors overlook this one.

If you work at a large public tech company, there’s a good chance you have access. Many use these plans to retain and reward highly compensated employees, especially those at the director level or above.

If that’s you and you’re not using it, you’re missing a powerful way to grow wealth and cut taxes. It’s not for everyone, but for certain situations, it’s incredibly powerful (especially for people getting ready to retire in a few years).

Enter the Non-Qualified Deferred Compensation (NQDC) Plan.

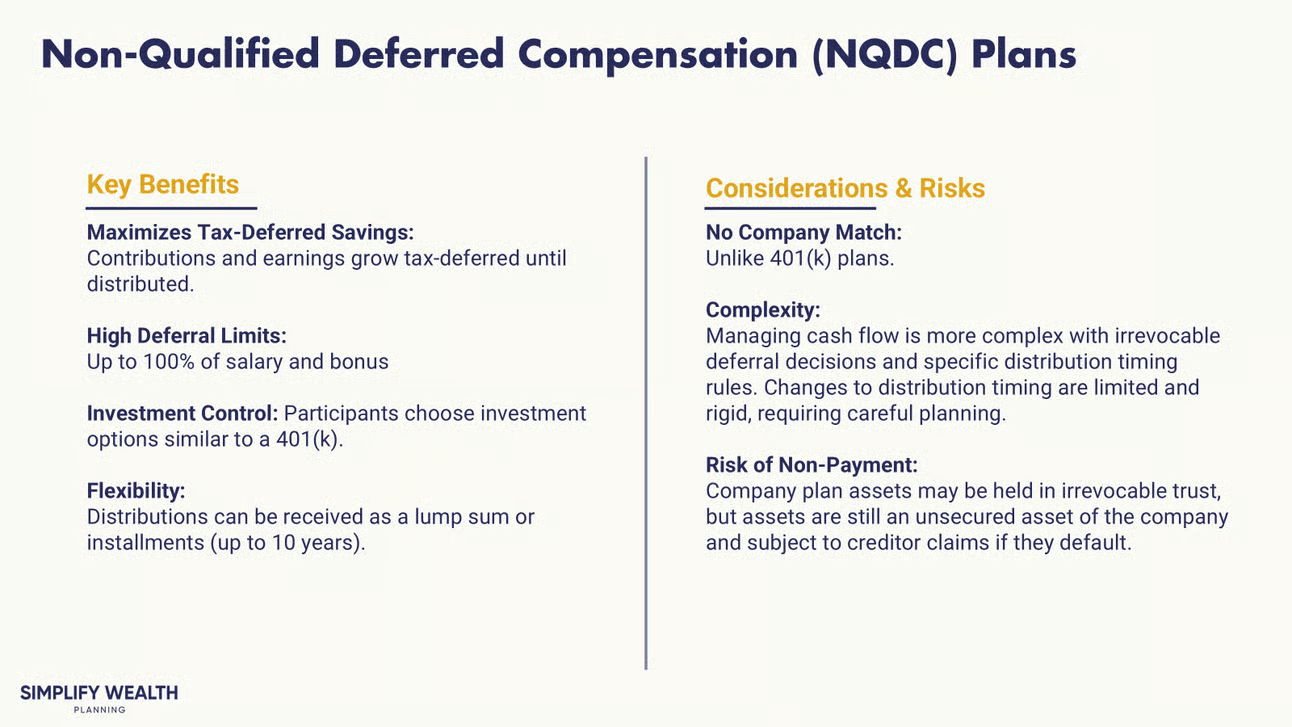

NQDC’s Two Core Benefits: Bigger Growth and Better Tax Timing

Let’s get clear on the basics first.

NQDC plans aren’t available to everyone. They are optional programs employers set up for a select group of employees. If you don’t see one in your benefits, it’s not something you can go out and create.

But if you do have access, here’s why they deserve your attention.

1. Pre-Tax Growth on More Dollars

You’ve likely already filled your 401(k). That’s great, but it only gets you so far.

The contribution limit for 2025 is $24,000. For someone earning multi-six figures, they often have a ton of cash flow remaining even after maxing out their 401k.

Anything above that is taxed immediately. So you're basically investing 60 cents on the dollar with everything you have left over.

NQDC plans change that.

You can defer a much larger slice of income. Often up to 100 percent of salary and 100 percent of bonus. That full pre-tax amount gets invested and compounds before any taxes are due.

Even if your tax rate remains the same when you realize the deferred income later on, the larger starting balance from which compounding occurs makes a significant difference.

This isn’t a tax loophole, it’s just better math.

2. Shift Income to Lower-Tax Years

If you're like most high earners, you're paying top tax rates right now. Federal, state and maybe local too.

But in retirement, or even during a career break, your income will likely drop, and so will your tax bill.

With an NQDC plan, you choose when to take the income. That gives you control. You can move it from high-tax years to lower-tax years. You can defer it while you're in California, then receive it while living in Texas, Florida, or other states with no income tax (huge tax wins if you do something like this).

That’s the strategy behind tax arbitrage. It doesn't require a change in rates. It just takes good timing.

Shifting large payouts out of high-tax years can create real, measurable savings.

3. What You Need to Watch For

NQDC plans come with tradeoffs, though.

If you defer your pay to a later date, the money isn’t yours yet. It’s a promise from your employer that they’ll pay you on the date you elected to receive the payment. That means if your company goes under, your deferred comp could be at risk. There’s no regulatory protection like there is with a 401(k).

This is a big reason why NQDC plans are often used by people nearing retirement or with other very specific use cases (planned multi-year sabbatical coming up, etc.)

You also have to make your decisions ahead of time.

Deferral elections typically happen the year before the income is earned (Usually in Q4 for the upcoming year). Once you choose, it’s usually locked in. The same generally applies to distribution timing, but that can have more flexibility depending on your plan’s specific terms.

So this isn’t a tool for people who want maximum flexibility. It’s for people who plan ahead and want to grow their wealth intentionally.

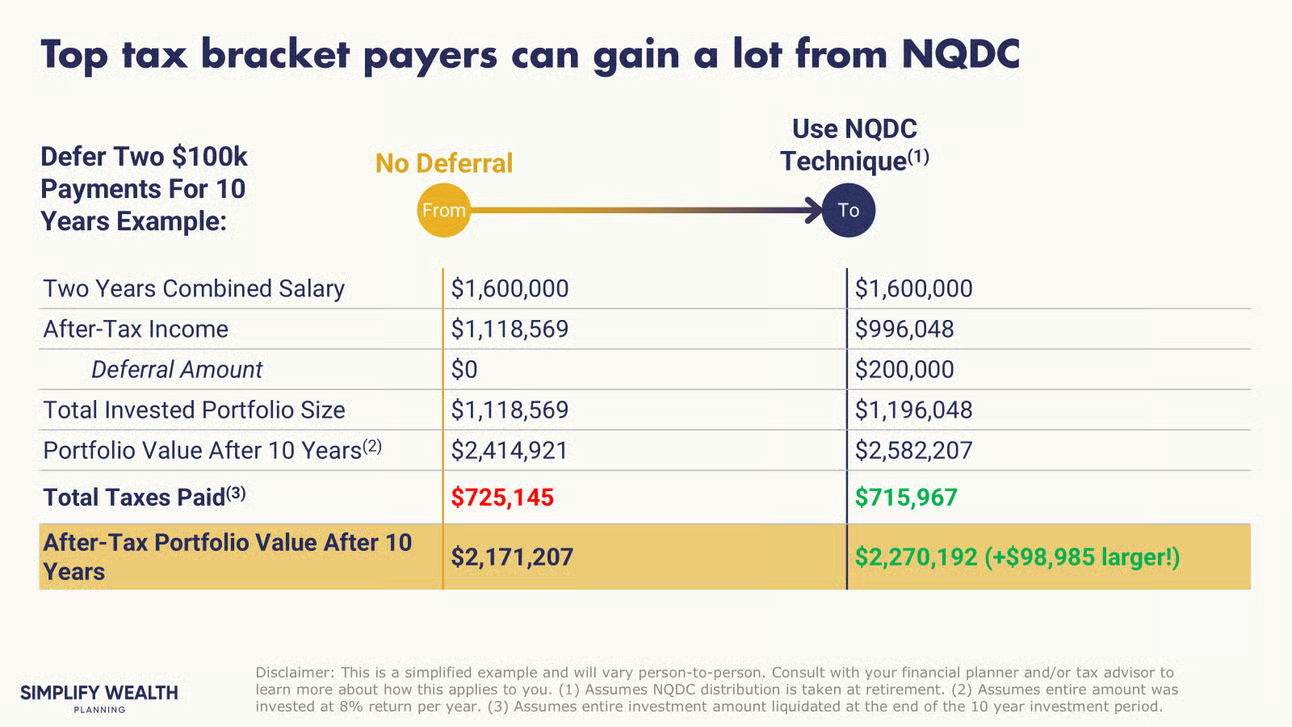

See the Difference

Let’s run the numbers.

We’re assuming in this case the person earned $800k but only deferred $100,000 each year into your NQDC for two calendar years. This represents a relatively small portion of their income, but as you’ll see, even somewhat small figures can offer huge benefits.

Now assume an 8 percent annual return. After 10 years, the difference in value is significant ($98,985 in the model I built!). Even after accounting for taxes when the NQDC is paid out, it still comes out massively ahead.

The value-add with NQDC will grow larger and larger vs the “No Deferral” election.

Because it starts with more money growing for more years, and the tax rate differential from when you claim the income.

Your Next Steps

If your employer offers an NQDC plan, here’s how to start thinking about it strategically:

1. Confirm Eligibility

These plans are not available to everyone. Ask your HR team if you qualify. Many large public tech companies extend them to director-level employees and above.

2. Read the Plan Rules

Look at how much income you can defer. Understand your investment crediting options. Pay close attention to how and when you can receive distributions (and whether amendments are allowed - very important).

3. Run a Side-by-Side Comparison

Compare what happens when you invest post-tax income versus deferring through an NQDC. Look at both the compounding growth and the tax savings from better timing.

4. Build Your Distribution Strategy

Coordinate NQDC payouts with other retirement income sources. Social Security, IRA withdrawals, etc. The goal is to avoid stacking high-income years in retirement.

5. Keep an Eye on Employer Risk

As your NQDC balance grows, so does your exposure. This is a deferred liability. Make sure your employer’s financial health remains strong. Adjust future deferrals if needed.

This isn’t something you blindly contribute to. It’s a planning tool, so use it that way.

Meme of the Week

Wrap-Up

NQDC plans aren’t just another HR checkbox.

They’re a way to grow more wealth with the income you’re already earning. You just need access, a plan, and a clear understanding of the tradeoffs.

If your employer offers one, it’s worth a second look.

Let’s model how it fits into your retirement picture.

Book your free “NQDC & Retirement Maximizer” session now.

–

Marcel Miu, CFA® and CFP® is the Founder and Lead Wealth Planner at Simplify Wealth Planning. Simplify Wealth Planning is dedicated to helping tech professionals master their money and achieve their financial goals.

This article first appeared on the Simplify Wealth Planning website and is republished on Flat Fee Advisors with permission.