Share this Post

“Mark” didn’t panic. That’s not what cost him.

He watched his company stock fall 30% over three quarters and held on, expecting a rebound. "Just give it time” is what he told himself. Then when the price dipped again, he didn’t know what to do. He hadn’t sold a single share.

Holding a concentrated stock position can do that to you. It feels too risky to move and too risky to sit still.

At the root of it, there’s not really a stock problem. There’s a priority problem. And once you name what matters most to you, the path forward gets a lot easier to manage.

The Four Primary Client Concerns

A concentrated stock position is one of those things that feels good until it doesn’t.

You can look at your net worth and feel great, but that confidence can turn quickly, especially if most of your wealth is tied up in one company. And the truth is, most people don’t actually have a plan for what they’ll do with it. They have a preference for good outcomes. That’s not the same thing.

Here’s where it all goes wrong: many people with concentrated stock challenges pick a strategy before they pick a priority.

They sell too fast and get hit with taxes they weren’t ready for.

Or they wait too long and erode their gains while “thinking it over.”

There isn’t one right answer here. But there is a right path for you.

You can build the right approach once you know what your top concern is with holding a concentrated stock position. These are the most common ones I see.

Concern 1: You want to reduce downside risk

This is the “I can’t afford to lose this” group.

You’ve worked hard and built up a position over the years as part of your compensation. And now most of your wealth is in a single stock. Watching it drop 30% is a real hit to your future.

You don’t need to guess on timing. You need protection (and the sooner, the better).

That’s where a few strategies come into play:

- Protective put options

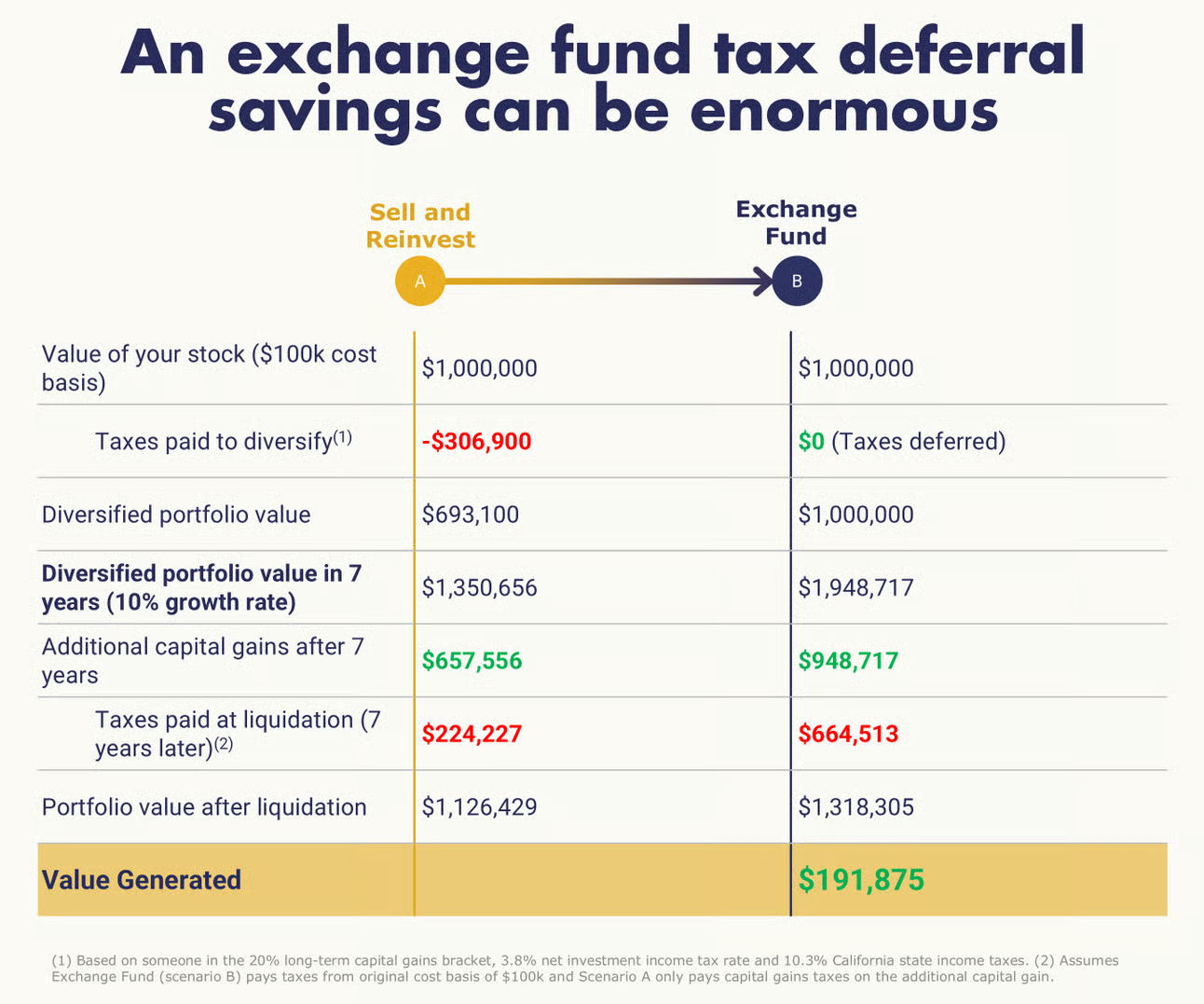

- Exchange funds that let you defer taxes while spreading the risk across other stocks

This is about laying a floor under that position, so you have time to make smarter moves later.

*Sadly, many of the strategies outlined in this article are not possible to use if you still work at the company, though. Be aware.

Concern 2: You want a slower exit

You don’t want out all at once. You just don’t want to be overexposed forever. But “slow exit” still has to mean something actionable.

You’ll want to be smart about how and when you trim your holdings.

You can:

- Build a capital gains budget and sell within that limit each year

- Use direct indexing to recreate overall market exposure while exiting your single-name position slowly

It’s one of the few ways to retain tax efficiency without staying locked in forever.

Concern 3: You want to reduce the tax burden

This camp understands one thing clearly: it’s what you keep after taxes that matters most.

Maybe you want to save taxes for yourself. Maybe you want to pass wealth to family in a lower tax bracket. Maybe you give generously and would rather donate stock than cash. Either way, this is about tax efficiency.

Strategies here include:

- Gifting to Donor Advised Funds or Charitable Remainder Trusts

- Transferring shares to family members or entities in lower tax brackets

- Considering a 351 exchange or exchange fund

This group is trying to optimize how that stock supports their overall plan.

Concern 4: You want options, but you're not ready to choose

This is common and reasonable. Markets move fast, and you feel overexposed, but you’re still weighing your long-term goals. You don’t want to act prematurely, but doing nothing starts to feel risky too.

This is when derivative overlays come in handy:

- Options collars

- Protective put options

These let you hang on until your goals are more defined or the timing is better.

Not all indecision is bad. Just make sure you’re building a framework around it.

Your Next Steps

1. Identify your main concern

Focus on one: managing risk, slow exit, tax planning, or staying flexible. Pick the one that feels most urgent.

2. Calculate your exposure

Run the numbers. What percent of your total net worth is in this stock? More than 25% is usually the point where most advisors flag real concentration risk.

3. Match your concern to your strategy

- Risk: protective puts, exchange funds

- Gradual exit: tax budgeting, direct indexing

- Tax optimization: gifting, CRTs, 351 exchanges, exchange funds

- Flexibility: options overlays

4. Create a basic 3-year roadmap

One milestone per year. Tie it to a clear event such as RSU vesting or a tax planning window. Then revisit it as your overall life, career, and market conditions shift.

5. Schedule your first review now

You don’t need to overhaul anything today. But you should set a date to check progress.

Use our free calculators below to start formulating your own strategy. Easy to follow models with video walkthroughs:

Meme of the Week

Wrap-Up

A concentrated stock position isn’t a problem to fix with one silver bullet. It’s a long-term asset that requires clear priorities and smart, disciplined planning to manage it well.

Start by identifying what matters most to you: risk, liquidity, taxes, or time. Then choose a strategy that aligns. If you want more guidance built around real-life goals, not theory, book a call here to talk through it.

–

Marcel Miu, CFA®, CFP® is the Founder and Lead Wealth Planner at Simplify Wealth Planning . Simplify Wealth Planning is dedicated to helping tech professionals master their money and achieve their financial goals.

This article first appeared on the Simplify Wealth Planning website and is republished on Flat Fee Advisors with permission.