Share this Post

How the Mega Backdoor Roth 401(k) Eliminates Tax Drag on Retirement Savings

Tax drag quietly erodes returns year after year. A Mega Backdoor Roth lets you shelter more money and keep millions compounding tax-free.

The “Maxed Out” Myth

Alex thought he was doing everything right.

Each year, like clockwork, he contributed the IRS max to his 401(k). He got the full match. He kept his portfolio diversified. He even rebalanced quarterly (almost no one gets around to doing this).

And yet, a quiet voice in the back of his mind kept asking:

“Is this really enough to retire on?”

It’s a familiar feeling for a lot of high earners. You’re disciplined and consistent, but once you hit that $23,500 contribution limit (2025), it feels like the door slams shut.

The truth is, for people people in tech (like Alex), that door isn’t locked. There’s a back entrance.

It’s called the Mega Backdoor Roth 401(k).

And if your company’s 401(k) plan allows it, this strategy could dramatically increase your tax-free retirement savings without needing to earn a penny more or work a day longer.

The truth is, for people people in tech, there’s a back entrance. It’s called the Mega Backdoor Roth 401(k).

The Real Threat Isn’t Market Volatility. It’s Tax Drag.

Most people think taxes only hurt at filing time.

They’re wrong.

The bigger pain point is what happens quietly, year after year, inside a taxable brokerage account.

Every dividend, capital gain, and interest payment chips away at your return.

That small bite is what we call “tax drag.” And for many investors, a conservative estimate is that it’s around 0.5% of lost return per year.

Sounds tiny, but here’s how tiny turns into terrifying:

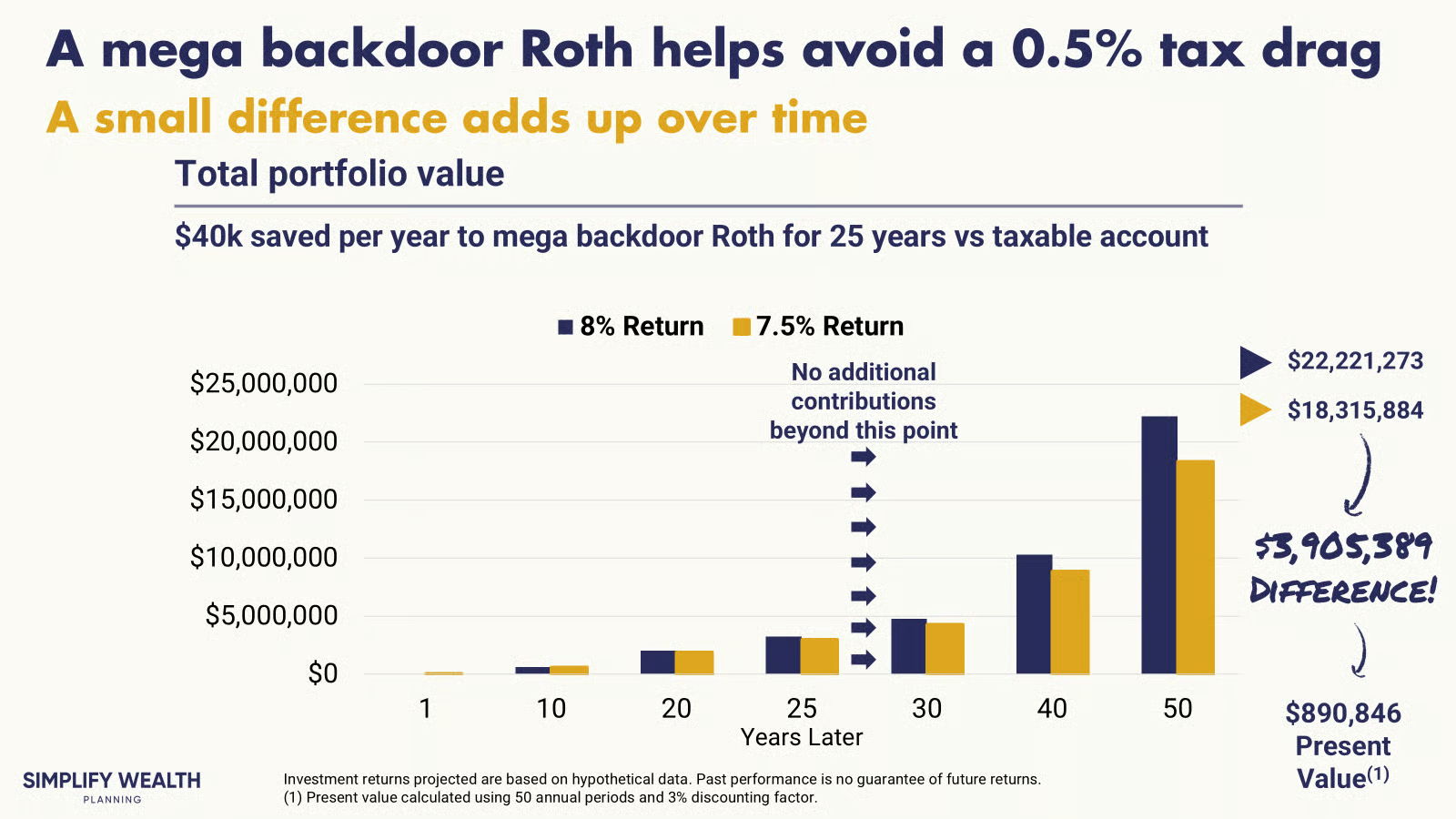

Bar chart comparing portfolio growth of saving $40,000 per year for 25 years into a mega backdoor Roth versus a taxable account, assuming either 8% or 7.5% annual returns. Scenario: $40K/year contributed for 25 years, then no further contributions. At Year 25: Contributions stop, but growth continues. At Year 50: Roth portfolio grows to $22,221,273. Taxable account grows to $18,315,884. Difference: $3,905,389 more in the Roth, equal to $890,846 present value today. Key takeaway: Even a 0.5% annual tax drag creates a multi-million-dollar gap over long time horizons, making the Roth strategy significantly more advantageous.

$40k/year contributed over 25 years. After 50 years, the Roth strategy ends up $3.9M ahead.

That’s not a typo. A 0.5% annual tax drag can erase almost $4 million over a long compounding period.

In today’s dollars, that’s like giving up nearly $900,000.

And typical financial planning says you should let your Roth account compound for as long as possible. So not tapping your Roth until you’re in your 70s might not be that far-fetched.

Let’s break down how to leverage the Mega Backdoor Roth to stop the leak.

The Three-Part Fix

1. After-Tax Contributions

Most people think the 401(k) limit is $23,500. And while that is technically true for employee deferrals, the real limit is $70,000 (2025, including employer match). If your plan allows after-tax contributions (i.e., money that you might otherwise throw into your taxable brokerage account), you can fill up to the $70,000 gap, even after you’ve maxed out your regular 401(k).

2. The Conversion

Once that after-tax money is in the plan, you move it to Roth. This happens one of two ways:

- In-plan Roth conversion

- In-service withdrawal to a Roth IRA

Both stop the tax drag before it starts.

3. Tax-Free Growth

Now that the money’s in Roth, it compounds untouched. All the annual tax friction is removed.

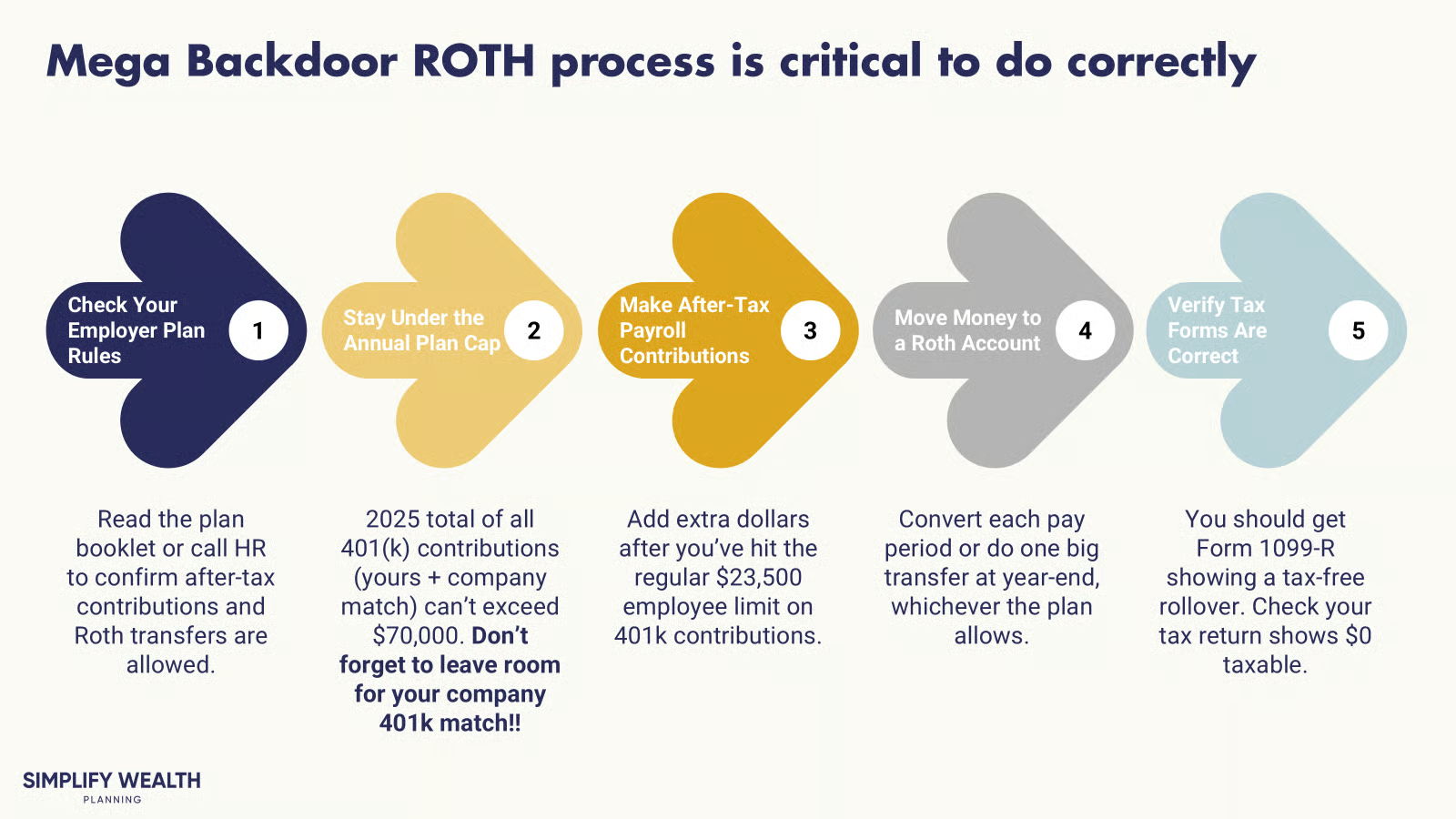

Your Next Steps

1. Call HR or Your Plan Administrator

Ask two specific questions:

- Does our 401(k) plan allow after-tax contributions beyond the $23,500 limit?

- Can I move those after-tax funds into a Roth, either in-plan or via in-service withdrawal?

2. Do the Math on Your Contribution Room

Take the total IRS limit for the year ($70,000 if under 50, $77,500 if over). Subtract your employee 401(k) deferral and your employer’s match. That’s your after-tax contribution opportunity.

3. Set Up Payroll Automation

Max your regular 401(k) first to get the full match (be aware of when your match actually happens so you don’t forget to leave room for it!). Then direct additional savings to the after-tax bucket.

4. Build a Conversion Habit

Once money hits after-tax, convert it fast (some plans allow this to happen automatically). The longer it sits unconverted, the more you risk some taxable growth.

5. Verify Tax Forms Are Correct

You should get Form 1099-R each year-end showing a tax-free rollover. Check that your tax return shows $0 taxable.

Here’s an easy-to-follow outline that you can save:

Five-step process diagram showing how to correctly implement a mega backdoor Roth strategy: Check Your Employer Plan Rules — Confirm if after-tax contributions and Roth transfers are allowed. Stay Under the Annual Plan Cap — For 2025, total employee + employer contributions can’t exceed $70,000; keep room for the company match. Make After-Tax Payroll Contributions — Add extra dollars beyond your $23,500 regular limit into after-tax 401(k) contributions. Move Money to Roth Account — Convert after-tax dollars into Roth, either each pay period or via one transfer per year. Verify Tax Forms Are Correct — Confirm 1099-R shows a tax-free rollover; check that taxable income reported is $0. Key takeaway: Following these steps prevents costly mistakes and ensures after-tax contributions flow smoothly into Roth accounts.

Meme of the Week

Go Farther Than “Maxed Out”

Most people stop when the IRS says “you’ve contributed enough.”

But that’s just the beginning for those who know how the system really works.

The Mega Backdoor Roth isn’t for everyone. But for those with access, it’s one of the cleanest ways to build long-term, tax-free wealth in large amounts.

And it’s one of the few strategies where saving more and paying less tax go hand-in-hand.

If your plan allows it, but you’re not confident in execution, this is where an advisor earns their keep. Especially if you want to coordinate tax strategy with broader planning.

–

Marcel Miu, CFA® and CFP® is the Founder and Lead Wealth Planner at Simplify Wealth Planning. Simplify Wealth Planning is dedicated to helping tech professionals master their money and achieve their financial goals.

This article first appeared on the Simplify Wealth Planning website and is republished on Flat Fee Advisors with permission.