Share this Post

Retirement Planning for High Net Worth Individuals

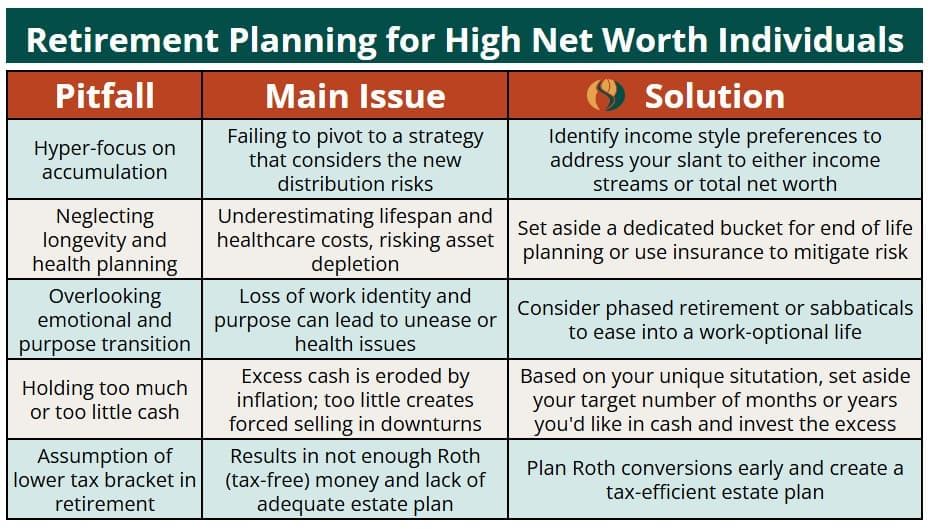

Retirement planning for high net worth individuals requires more than hitting a number—it demands personalized strategies to manage taxes, healthcare costs, and purpose-filled living. With $1M+ in investable assets, common pitfalls include poor withdrawal sequencing, holding too much or too little cash, assuming lower retirement tax brackets, and overlooking the emotional shift from career to purpose. This guide offers solutions like Roth conversions, estate strategies, and dynamic spending to help you build a secure and meaningful retirement.

Defining “High Net Worth”

Before diving into retirement strategies, let’s clarify what “high net worth” actually means. Typically, financial institutions classify individuals with $1-5 million in investable assets as high net worth (HNW), while those with $5-30 million fall into the “very high net worth” category. However, these definitions can vary widely depending on the financial institution and geographic location.

In the Pacific Northwest for example, local economic factors and cost of living considerations may influence how we define high net worth. What matters most isn’t the label, but recognizing that your financial situation requires personalized planning that accounts for your unique circumstances and aspirations.

The Myth of the “Magic Number”

One of the most persistent misconceptions in retirement planning is the idea that there’s a universal “magic number” everyone should target. You’ve likely heard statements like:

- “You need $3 million to retire comfortably”

- “The 4% rule guarantees you won’t run out of money”

- “You need to replace 80% of your pre-retirement income”

These oversimplified formulas ignore crucial factors that significantly impact your retirement needs. Your lifestyle design—whether that involves international travel, philanthropy, creative pursuits, or community engagement—requires completely different financial structures that can’t be reduced to a single target number. Geographic considerations matter tremendously, as the financial requirements for retirement in Gig Harbor or Tacoma differ dramatically from those in San Francisco or rural Montana. Additionally, the evolving tax environment creates ongoing complexity, as high net worth individuals must navigate changing legislation around retirement distributions, Roth conversions, capital gains, and estate planning strategies that may require regular adjustment as laws evolve in each state.

Common Pitfalls in High Net Worth Retirement Planning

Pitfall #1: Hyper focus on Accumulation Instead of Distribution Strategy

Many successful professionals excel at building wealth but underestimate the technical & emotional complexity of distribution planning. Accumulation is sometimes straightforward—just invest in a diversified portfolio of mostly stock funds and you might be good. However, effective distribution strategy involves sophisticated strategies around timing, market risk, taxation, and longevity. You must navigate RMDs, social security, and market downturns (which are a now a larger risk), all on a potentially fixed income.

Solutions: Identify your updated risk tolerance around retirement spending, such as determining if you have a preference for earning the highest potential total market return vs. giving up some return for a guaranteed income stream. You also need to consider if you want to spend more early on to enjoy life while young vs. saving more for the end of life. To do this, you’ll develop distribution strategies that go beyond simple withdrawal rates, incorporating multi-account sequencing, dynamic spending adjustments, and flexible withdrawal approaches that adapt to market volatility and changing personal needs.

Pitfall #2: Neglecting Longevity and Health Planning

With advances in healthcare and wellness, many high-net-worth individuals need to plan for potentially longer lifespans than previous generations. This prolonged retirement horizon requires sophisticated planning around escalating healthcare costs, long-term care possibilities, and legacy considerations. As of 2025, the average amount spent on healthcare in the final two years of life for a 65 year old is almost $250,000 in today’s dollars (so they would need to set aside $250,000 for long-term care, or use that same amount to secure insurance). Much of this is due to the extremely high costs of long-term care. While some states like Washington State are attempting to create long-term care safety nets they are likely insufficient to rely on.

Solution: While still in the accumulation phase, health savings accounts (HSAs) provide a great option for future health costs since the value can roll over from year to year and be invested for tax-free compounded interest accumulation if used for healthcare. Additionally, one needs to decide if they will self-insure for long-term care or buy insurance. While regular long-term care insurance is expensive, there are some life and long-term care hybrid products that can make it a bit easier on the budget. Depending on your family situation and risks, you may opt for insurance or you may decide to self-insure instead by putting a portion of your earnings aside just for end of life expenses.

Pitfall #3: Overlooking the Emotional and Purpose Transition

Retirement isn’t just a financial event—it’s a major life transition that affects identity, purpose, relationships, and daily structure, especially for high-achieving professionals who’ve derived significant meaning from their careers. The abrupt shift from meaningful work to traditional retirement can create cognitive and social risks, including depression or lowered life expectancy.

Solution: Begin planning for the non-financial aspects of retirement well before your target date and avoid viewing retirement as a “finish line.” The WATER, not FIRE approach to retirement planning focuses on creating flexible pathways that might include sabbaticals, career pivots that increase impact, phased retirement approaches, or consulting arrangements that leverage your expertise while providing the rest and renewal you deserve. Rather than viewing retirement as a binary switch from “working” to “not working,” WATER supports the nuanced transitions that actually serve high-achieving professionals who want to continue contributing meaningfully while also prioritizing health, relationships, and personal fulfillment.

Additionally, values-aligned investing can bring more personal fulfillment and a sense of continued contribution to causes you care about.

Pitfall #4: Holding Too Much or Too Little Cash

Excessive cash loses value due to inflation, while insufficient liquidity risks forced asset liquidation at a loss during market downturns. High-net-worth individuals often struggle with the balance between safety and growth, particularly as they approach or enter retirement.

Solution: Balance cash holdings with growth investments to maintain purchasing power and flexibility. Implement a strategic cash management approach that maintains appropriate liquidity buffers while ensuring the majority of assets continue growing to outpace inflation. Determining your “cash number” or “cash percent” is different for each person and can vary from several months to several years of reserves depending on tolerance, total net worth, lifestyle, and complexity.

Pitfall #5: Assuming you’ll be in a lower tax bracket in retirement

Many high-net-worth individuals assume their tax rate will drop in retirement, but that’s often not the case. Required Minimum Distributions (RMDs), investment income, and Social Security can keep retirees in high tax brackets—especially without strategic planning. Poor withdrawal sequencing can lead to unnecessarily high taxes and reduced portfolio longevity

Solution: Instead, it’s critical to use multi-year tax projections and develop a coordinated withdrawal strategy across account types. Strategic Roth conversions—ideally before retirement—can reduce taxable income later and support more flexible income planning. This is also the stage where estate planning becomes crucial: not just for family stability, but for passing on wealth in a tax-efficient way that preserves more for future generations.

Beyond the Numbers: Creating a Purpose-Filled Retirement

For high-net-worth individuals, particularly those who’ve built impactful careers, retirement planning must transcend purely financial considerations. The most satisfying retirements typically involve:

Reimagining Contribution

Many professionals find fulfillment in redirecting their expertise toward meaningful causes, whether through mentoring, board service, philanthropy, or part-time consulting. This creates purpose while leveraging decades of valuable experience.

Balancing Structure and Freedom

After years of demanding schedules, finding the right balance between structure and spontaneity becomes crucial. The most successful retirees create flexible routines that provide meaning while allowing for adventure and new experiences.

Nurturing Relationships

Retirement offers opportunities to deepen family connections, renew friendships, and build new communities. Intentional relationship building should be a central part of your retirement strategy.

Personal Growth and Learning

Many high net worth individuals find retirement an ideal time to pursue intellectual passions, creative endeavors, or physical challenges that work life didn’t accommodate.

Conclusion: Retirement as Reimagination

Effective retirement planning for high-net-worth individuals isn’t just about reaching a number—it’s about designing a purposeful next chapter that aligns with your deepest values and aspirations. It requires technical expertise complemented by genuine curiosity about what makes life meaningful for you.

At Equal Path Investments, we specialize in guiding intentional professionals through this transition, helping them turn financial success into purposeful impact. Our flat-fee, education-first approach ensures that you receive objective advice tailored to your unique situation.

Whether you’re five years from retirement or already transitioning, we invite you to explore a different approach to financial planning—one that honors both the practical and aspirational dimensions of this significant life transition.

–

Carlie Ransom, CFP®, co-founder of Equal Path Investments, helps thoughtful professionals align their finances with a life of rest, reinvention, or purpose—without rushing to retire or sacrificing joy along the way.

This article first appeared on the Equal Path website and is republished on Flat Fee Advisors with permission.