Share this Post

One decision turned a tax-free windfall into a crushing tax bill. Don’t let it happen to you.

The Mistake That Stings Years Later

Dev sat in his car, gripping the steering wheel so hard his fingers went numb.

His company just got acquired. His shares were worth two million. He should’ve been popping champagne. Instead, he’d just hung up with his tax advisor, who explained how a single decision he made years ago was about to cost him nearly seven hundred thousand dollars in taxes he didn’t have to pay.

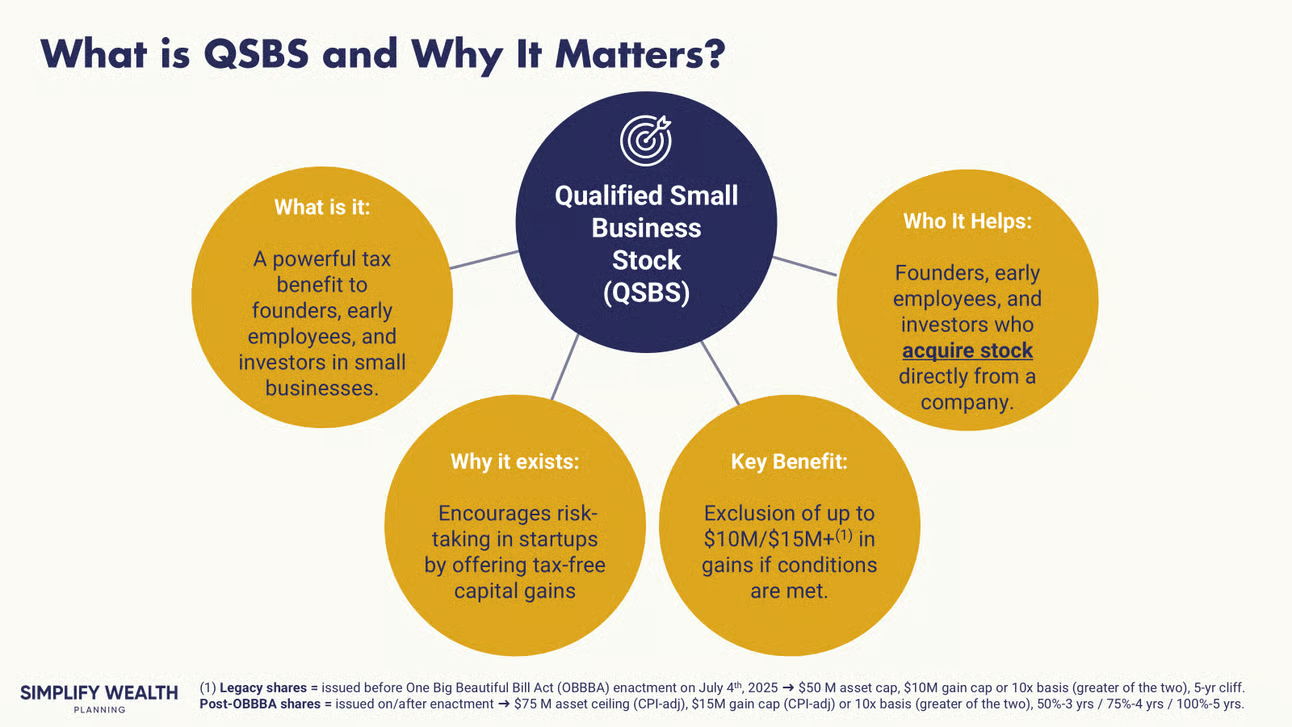

He was an early believer and earned every penny of that equity. But he’d missed the real prize hiding in his shares: tax-free capital gains under Qualified Small Business Stock (QSBS) laws. The costliest mistake an early-stage startup employee can make.

Why Your Windfall Is on a Ticking Clock

A lot of early employees think QSBS is locked in the day they get their stock options. It isn’t, and this is the biggest misconception related to QSBS (and a very expensive one).

QSBS only counts once you actually own the shares. Meaning if you have stock options, you need to have exercised them and paid your company the $$ to acquire them. And you need to acquire them while your company still qualifies as a “small business.” The IRS watches the size of your company’s assets the moment you exercise your options. Not your company’s valuation, but the actual gross assets sitting on the accounting books.

Here’s why that matters:

If your company raises big funding rounds before you exercise, there’s a good chance they’ll shoot past the asset cap that allows them to still qualify as a “small business”. That means your stock no longer qualifies for QSBS. So if your company ends up being successful (i.e., exit event happens), your tax bill goes from zero to hundreds of thousands.

QSBS only counts once you actually own the shares.

How most people blow it:

Most folks wait for a liquidity event to exercise their options. They want certainty. They figure, “Why risk cash on a company that might not go anywhere?” By then, it’s often too late. The company has grown, the asset cap’s been blown through, and the chance for tax-free gains is gone for good.

Assets Matter More Than Valuation

Here’s the sneaky part.

Your company might flaunt a $150 million valuation. That doesn’t mean it’s blown through the QSBS asset limit of $75 million. The IRS cares about what’s actually on the balance sheet - mostly cash, equipment, and IP cost basis.

So a company can look huge from the eyes of investors, but still be under $75 million in assets. That’s the window when early employees can exercise and start the QSBS clock.

The “One Big Beautiful Bill Act” Changes the Game

On July 4, 2025, the rules changed. The OBBB Act did two big things:

1. Higher Asset Cap

The ceiling for company book assets to qualify for QSBS jumped from $50 million to $75 million, plus it will be adjusted for inflation moving forward. That gives your company more breathing room to grow before QSBS is off the table.

2. Partial Tax Breaks Earlier

Before, you had to hold your stock for five years to get any QSBS benefit. Now you can start getting benefits after three years.

This new structure cuts down the risk of holding private stock for half a decade with nothing to show for it.

How QSBS Plays Out in an Acquisition

If there’s an acquisition on the horizon, it’s not automatic doom for your required QSBS holding period. But it’s tricky.

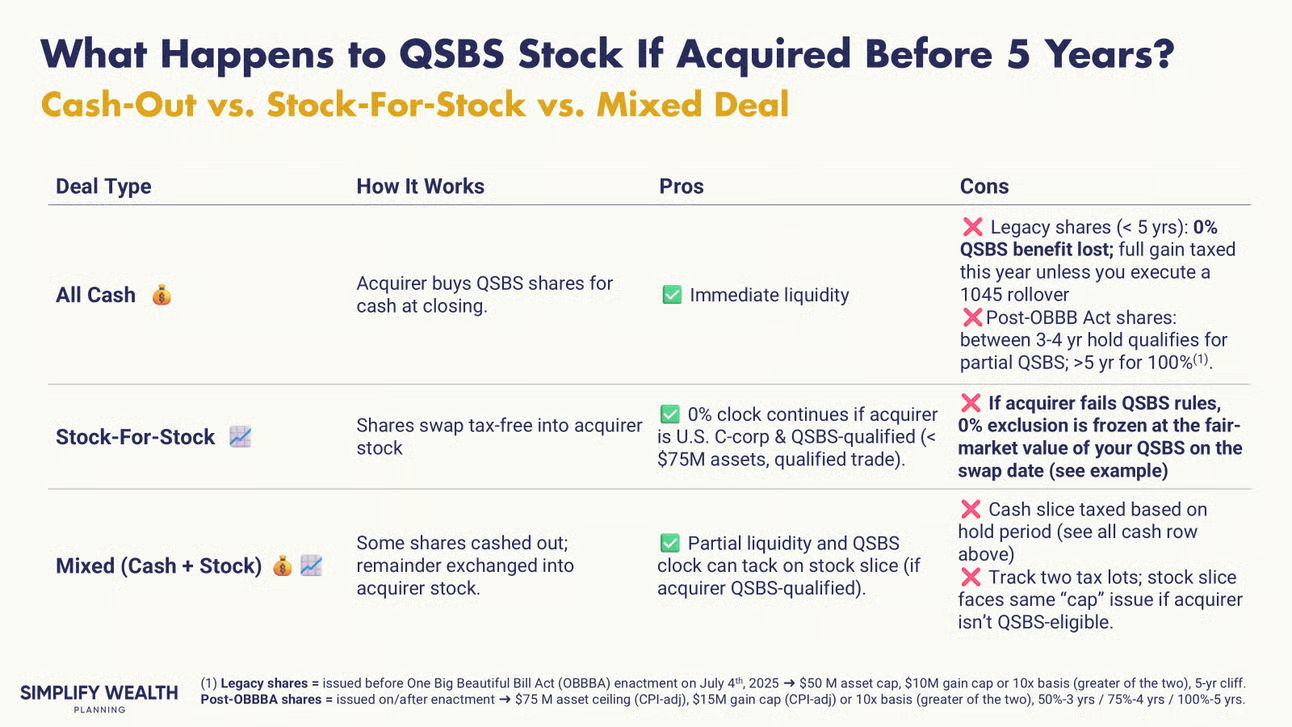

Cash-Out Deal:

If you’re paid cash for your stock before finishing your required holding period, you lose QSBS unless you’ve already crossed the minimum time. But you might dodge the hit using a Section 1045 rollover. Reinvest your cash into another QSBS-eligible company within 60 days, and your clock keeps ticking.

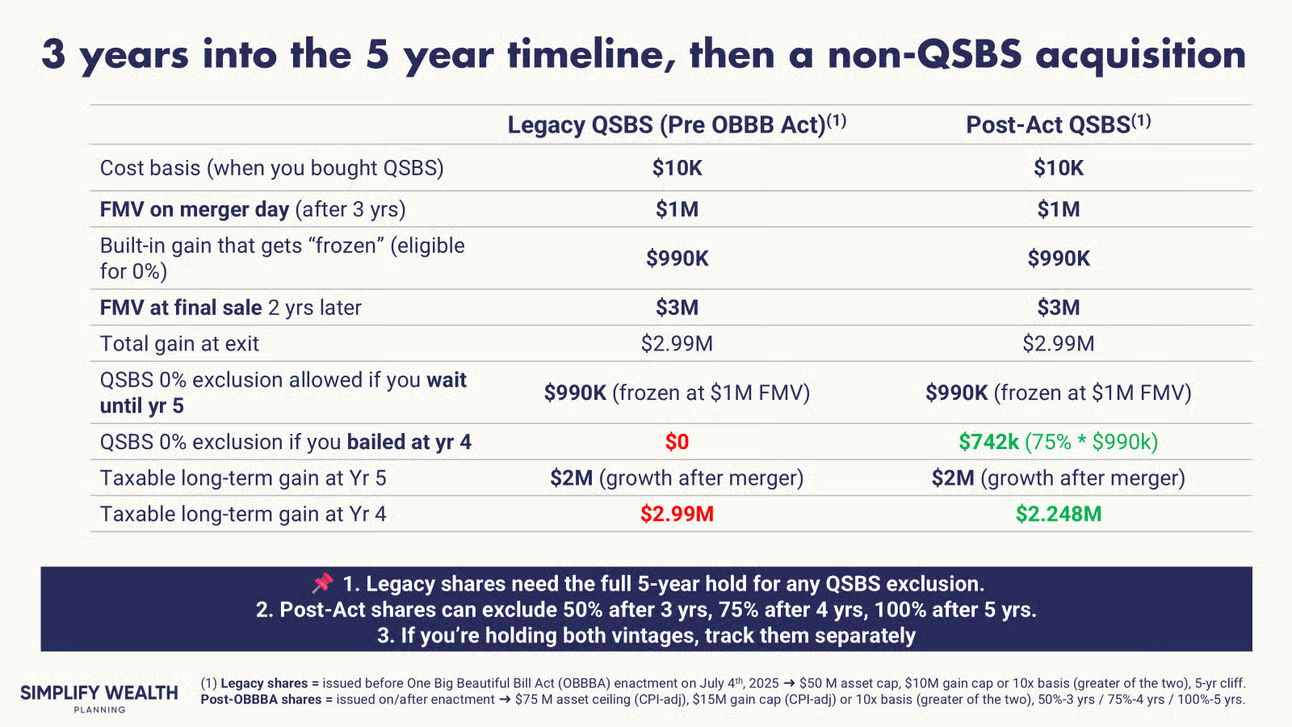

Stock-for-Stock Deal:

If you’re forced to trade your QSBS shares for stock in the buyer, your holding period can keep going. The catch is that if the acquirer isn’t a qualified small business, your future growth becomes taxable above the value set at the merger date. You don’t lose the benefit entirely, but your tax-free gain freezes.

It’s confusing, but the example below should help.

Your Next Steps

Here’s how to keep Dev’s story from becoming yours:

1. Ask for Proof of QSBS Status

Go to your finance or legal team. Request a QSBS attestation letter if they have one. Platforms like Carta might even have it ready to download.

2. Know Your Deadline

Find out when your company expects to cross the $75 million asset mark (again, this is not the same thing as valuation). This is often around Series B, but can be earlier than that. That’s your drop-dead date for exercising options.

3. Model the Early Exercise Cost

Running the numbers matters. How much cash will it take to exercise? Will you trigger AMT if you have ISOs? Put it on paper. A twenty-thousand dollar spend now could save many hundreds of thousands later (or even millions).

4. Gut-Check Your Risk Tolerance

Before you pull the trigger, ask yourself:

- Will a zero tax bill at exit help you hit a big life goal?

- Can you afford the cash cost without blowing up your finances if the company tanks?

- Can you tie up that money for at least three to five years?

If you’re nodding to two out of three, time to build your QSBS plan.

Meme of the Week

Your Employee Stock Options Are an Asset, Not a Paycheck

Your stock options aren’t just pieces of paper. They’re potential tax assets that need active planning to turn into real wealth.

If you’re at an early-stage startup, this might be the single biggest financial move you make in your career. Let’s make sure you get it right. Schedule a complimentary call if exercising your company’s QSBS shares is something you’re unsure of. Together, we’ll run your numbers, map your deadlines, and protect your potential tax-free windfall.

–

Marcel Miu, CFA® and CFP® is the Founder and Lead Wealth Planner at Simplify Wealth Planning. Simplify Wealth Planning is dedicated to helping tech professionals master their money and achieve their financial goals.

This article first appeared on the Simplify Wealth Planning website and is republished on Flat Fee Advisors with permission.