Share this Post

TL;DR

For tech professionals, selling RSUs, especially right after vesting, often creates small but recurring short-term capital gains due to blackout periods and price movements. These short-term gains are typically taxed at your highest ordinary income rate. Direct indexing offers a potential solution by systematically generating capital losses (often short-term losses), which may help neutralize this tax friction. This approach seeks to improve a portfolio's potential after-tax return without significantly altering its intended market exposure.

The "Sell Immediately" Tax Trap

Imagine you're a diligent tech pro who sells your RSUs as soon as they vest to diversify. It seems like the standard advice. But company policy enforces a trading blackout period around earnings, so you often have to wait a week or two (or longer). In that time, the stock ticks up a few percent. You followed common practice, yet at tax time, you might find yourself facing thousands of dollars in short-term capital gains.

It might not be a catastrophic bill, but it can be a persistent drag on your wealth accumulation. It can feel like a penalty for trying to manage your investments responsibly.

This "tax friction" is an often-overlooked side effect of many equity compensation plans. While you are trying to be a disciplined investor, the structure of these plans can create a tax drag that may reduce your overall potential returns. It’s a quiet issue that can compound over time.

Why Does My Smart Equity Strategy Still Trigger High Taxes?

The answer often lies in timing. Even small delays between when you acquire your shares (vesting date for RSUs) and when you are permitted to sell them can create short-term capital gains. These gains are generally taxed at the same rates as your salary.

Your equity compensation plan operates on a set schedule, but the market moves independently. RSU blackout periods illustrate this well. Your RSUs are usually taxed as wage income on the vest date, based on that day's price. However, company blackout periods related to earnings reports or other events can prevent you from selling immediately. If the stock price increases between the vest date and your eventual sale date, that appreciation is generally considered a short-term capital gain.

How Can I Offset These High-Tax Gains?

One potential strategy to neutralize short-term capital gains involves systematically harvesting short-term capital losses from your taxable investment portfolio. The IRS generally allows these losses to offset gains on a dollar-for-dollar basis.

The tax code requires you to first net capital losses against capital gains of the same type (i.e., short-term gains vs. short-term losses). Since gains from immediate RSU sales are often short-term, a strategy that seeks to consistently generate short-term losses may be advantageous.

Important: Tax laws are complex and subject to change. There is no guarantee that sufficient losses will be available to offset gains, or that the strategy will result in a net tax benefit.

Direct Indexing: A Key Component for Automated Loss Harvesting

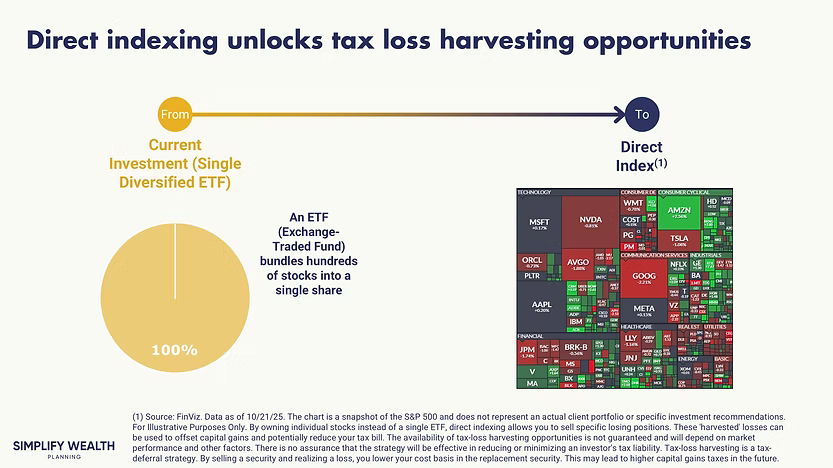

Direct indexing may offer more opportunities to harvest losses compared to holding a single broad-market ETF. Instead of owning one fund, you own the hundreds of individual stocks that make up the index directly. This structure allows for the possibility of selling specific losing positions to generate tax losses, even when the overall market index has increased in value. An ETF, being a single security, generally only allows for loss harvesting if the entire ETF's price has declined.

A direct indexing platform typically monitors hundreds of individual stock positions. Software can be used to automatically identify and sell a stock that has declined below its purchase price, thereby capturing a loss for tax purposes. The proceeds are often reinvested into a similar, but not "substantially identical," stock to maintain the portfolio's desired market exposure and risk characteristics. This automated process aims to systematically generate potential tax assets (capital losses).

Visual comparison showing a single ETF pie chart versus a direct index portfolio heatmap of individual stocks, explaining how owning individual stocks through direct indexing creates more opportunities for tax-loss harvesting than owning a single ETF.

However, the effectiveness depends on market volatility and the specific parameters used. Automation does not eliminate investment risk or guarantee tax savings.

Clearing the Air: Is Direct Indexing the Answer for Concentrated Stock?

Probably not as a primary strategy. While direct indexing plus tax-loss harvesting strives to generate capital losses, it is often insufficient to meaningfully address the risk inherent in a large, concentrated single-stock position. The potential losses generated from a diversified direct index portfolio are unlikely to be large enough to offset the significant gains embedded in a multimillion-dollar concentrated holding.

The primary goal when dealing with a large concentrated position is usually risk reduction, which often requires specialized strategies. Direct indexing plus tax-loss harvesting focuses on tracking an index while seeking tax efficiency through frequent, smaller loss harvests. It is generally not designed as the main tool to de-risk a large single-stock holding.

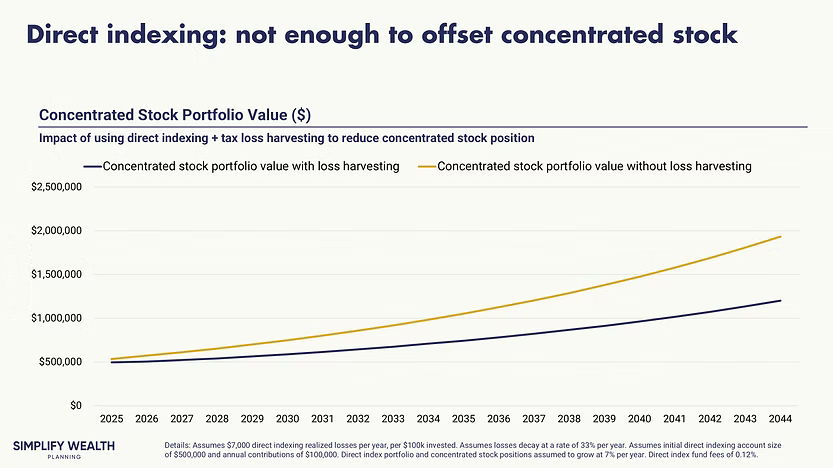

Line chart comparing the value of a concentrated stock position over time with and without tax-loss harvesting via direct indexing, demonstrating that direct indexing alone is insufficient for substantially reducing concentrated stock risk.

This hypothetical illustration shows that while tax-loss harvesting within a direct index portfolio (blue line) may offer benefits compared to a portfolio without it (yellow line), its impact on reducing a very large, separate concentrated stock position is generally limited.

For strategies more specifically aimed at managing concentrated stock risk, such as exchange funds, collars, or variable prepaid forwards, consider reading our educational piece here: How to Diversify Your Concentrated Stock Position Without a Massive Tax Bill.

The potential strength of direct indexing plus tax loss harvesting for many tech professionals often lies more in addressing the recurring tax friction from ongoing RSU activity.

What Is the Real Value of This Strategy?

The potential "tax alpha" - the additional after-tax return that might be generated purely from tax savings - from a well-executed direct indexing and tax-loss harvesting strategy can be noteworthy for investors in high tax brackets. Some studies suggest it could potentially add over 1% to after-tax returns annually under certain market conditions and tax situations (although my own research says this number is closer to 0.5% for most situations I come across). This potential benefit arises from using harvested losses to offset high-tax short-term gains (turning them into tax-neutral events) and potentially deferring tax liability further into the future, allowing assets more time to compound.

The exact potential value for you depends heavily on your tax rates, the size and frequency of your equity compensation events, market volatility, and your overall tax picture.

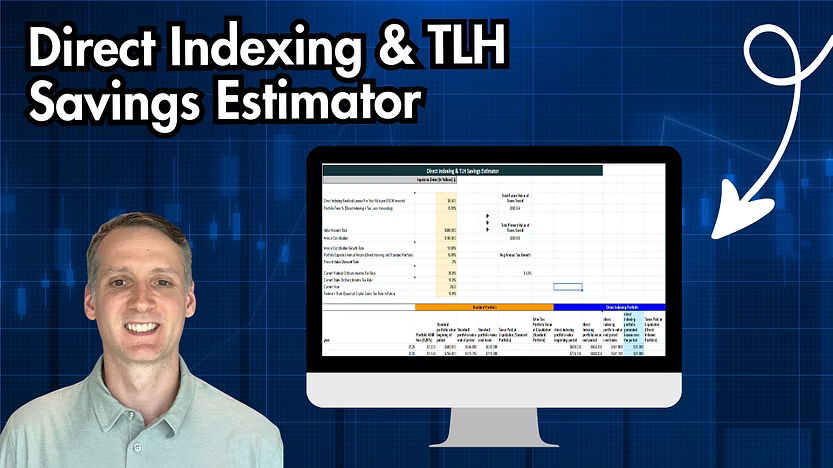

To help illustrate how this might apply to a hypothetical situation, we have developed an educational tool, the Direct Indexing & Tax Loss Harvesting Savings Estimator (with video walkthrough). You can input hypothetical numbers to explore the potential impact on taxes. This tool is for illustrative purposes only and does not predict or guarantee results.

Financial advisor showcasing the Direct Indexing & TLH Savings Estimator spreadsheet tool, a resource for tech professionals to estimate potential tax savings from using direct indexing to offset RSU and ESPP gains.

Please Note: This tool is for illustrative purposes only and does not predict or guarantee results. "Tax alpha" is not a guaranteed additional investment return. It is a measure of potential tax savings, which are dependent on having gains to offset, sufficient losses to harvest, and individual tax circumstances.

FAQs

Is direct indexing worth the higher fee compared to a low-cost ETF?

Direct indexing plus tax loss harvesting typically involves slightly higher management fees than passively managed ETFs. For tech professionals with substantial annual short-term capital gains from RSU sales who are in high marginal tax brackets, the potential tax savings generated by systematically harvesting losses may exceed the slightly higher management fee. This results in a potential net benefit to the after-tax return, but it is not guaranteed and depends heavily on individual circumstances and market behavior.

Isn't there a risk that the replacement stock underperforms the one sold for a loss?

Yes, this risk is known as tracking error. When a stock is sold for a loss, it's replaced with a different but similar stock to maintain market exposure. If the replacement stock performs differently from the original, the portfolio's return will deviate slightly from the index it aims to track. Direct indexing platforms use sophisticated optimization techniques to select replacements that closely mirror the risk characteristics of the original stock, aiming to minimize this tracking error over the long term. However, tracking error can occur and may positively or negatively impact returns relative to the benchmark.

Can I implement direct indexing and tax-loss harvesting myself?

While theoretically possible, managing a direct index portfolio effectively involves significant complexity. It requires tracking the cost basis for hundreds of individual stocks, constantly monitoring for loss harvesting opportunities according to specific parameters, selecting appropriate replacement securities, and carefully managing wash sale rules across all household accounts (including spousal accounts). Specialized software and professional oversight often add value through automation, optimization, and potentially reducing costly errors.

Your Next Steps

Here are some steps to consider if you want to better understand your situation:

- Quantify Your Potential Tax Friction. Review your Schedule D, Part I, from your latest tax filing. Identify and sum up the amounts listed under "short-term capital gain." This figure represents the potential tax drag you might be able to address.

- Run a Personalized Scenario. Use our educational Direct Indexing & TLH Savings Estimator tool. Inputting hypothetical figures based on your situation can provide a tangible illustration of the potential tax impact this strategy could have. Remember, this is an estimate for informational purposes only.

- Get a Professional Perspective. Tax-loss harvesting and direct indexing are most effective when integrated into a comprehensive financial plan that considers your entire financial picture, including all forms of equity compensation, your goals, and risk tolerance.

Turn Tax Friction into a Tailwind

Those recurring short-term capital gains generated by RSU sales can act as a persistent drag on your wealth accumulation. Instead of viewing this tax friction as unavoidable, consider exploring strategies like direct indexing. This approach aims to use market volatility to create potential tax-saving opportunities, potentially enhancing your after-tax compounding over time.

Tired of seeing short-term gains eat into your wealth? Let's talk about building a plan designed for tax efficiency. Schedule an introductory call today to learn more about our approach and determine if our services are a good fit for you.

–

Marcel Miu, CFA® and CFP® is the Founder and Lead Wealth Planner at Simplify Wealth Planning. Simplify Wealth Planning is dedicated to helping tech professionals master their money and achieve their financial goals.

This article first appeared on the Simplify Wealth Planning website and is republished on Flat Fee Advisors with permission.